Tariff Law Book 1

TITLE I

Import Tariff

SECTION 101. Imported Articles Subject to Duty. — All articles, when imported from any foreign country into the Philippines, shall be subject to duty upon each importation, even though previously exported from the Philippines, except as otherwise specifically provided for in this Code or in other laws.

SECTION 102. Prohibited Importations. — The importation into the Philippines of the following articles is prohibited:

a. Dynamite, gunpowder, ammunitions and other explosives, firearms, and weapons of war, and parts thereof, except when authorized by law.

b. Written or printed articles in any form containing any matter advocating or inciting treason, rebellion, insurrection, sedition or subversion against the Government of the Philippines, or forcible resistance to any law of the Philippines, or containing any threat to take the life of, or inflict bodily harm upon, any person in the Philippines.

c. Written or printed articles, negatives or cinematographic films, photographs, engravings, lithographs, objects, paintings, drawings or other representation of an obscene or immoral character.

d. Articles, instruments, drugs and substances designed, intended or adapted for producing unlawful abortion, or any printed matter which advertises or describes or gives directly or indirectly information where, how or by whom unlawful abortion is produced.

e. Roulette wheels, gambling outfits, loaded dice, marked cards, machines, apparatus or mechanical devices used in gambling, or in the distribution of money, cigars, cigarettes or other articles when such distribution is dependent upon chance, including jackpot and pinball machines or similar contrivances, or parts thereof.

f. Lottery and sweepstakes tickets except those authorized by the Philippine Government, advertisements thereof and lists of drawings therein.

g. Any article manufactured in whole or in part of gold, silver or other precious metals or alloys thereof, the stamps, brands or marks of which do not indicate the actual fineness of quality of said metals or alloys.

h. Any adulterated or misbranded articles of food or any adulterated or misbranded drug in violation of the provisions of the “Food and Drugs Act”.

i. Marijuana, opium, poppies, coca leaves, heroin or any other narcotics or synthetic drugs which are or may hereafter be declared habit forming by the President of the Philippines, or any compound, manufactured salt, derivative, or preparation thereof, except when imported by the Government of the Philippines or any person duly authorized by the Dangerous Drugs Board for medicinal purposes only.

j. Opium pipes and parts thereof, of whatever material.

k. All other articles and parts thereof, the importation of which is prohibited by law or rules and regulations issued by competent authority. (As amended by Presidential Decree No. 34).

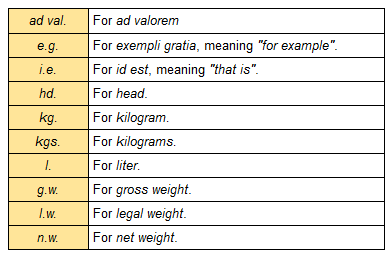

SECTION 103. Abbreviations. — The following abbreviations used in this Code shall represent the terms indicated:

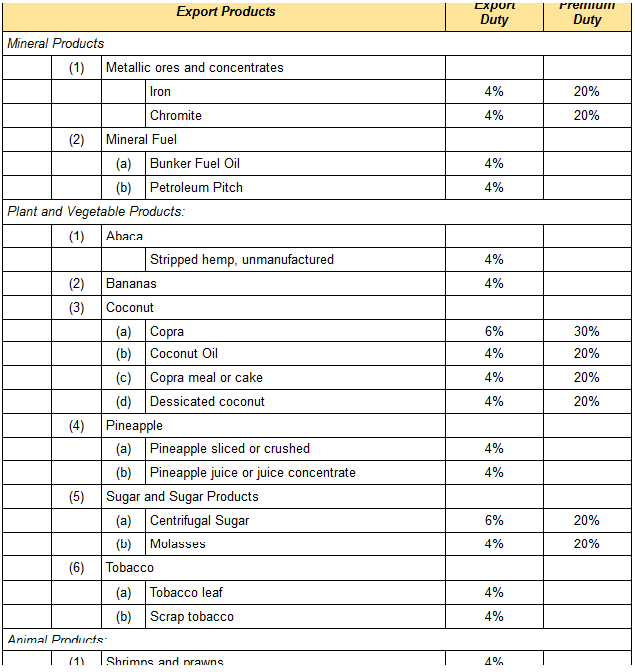

SECTION 104. All tariff schedules, chapters, headings and sub-headings and the rates of import duty under Section 104 of Presidential Decree No. 34 and all subsequent amendments issued under Executive Orders and Presidential Decrees are hereby adopted and form part of this Code.

A uniform rate of duty, herein known as a revenue duty of ten per cent ad valorem shall be imposed on all imported articles plus any of the five rates of duty of 10, 20, 40, 60 and 90 per cent ad valorem. In effect, there are only six levels of tariffs: 10 per cent (basic rate), 20%, 30%, 50%, 70% and 100%.

The rates herein provided or subsequently fixed pursuant to Section Four hundred one of this Code shall be subject to periodic investigation by the Tariff Commission and may be revised by the President upon recommendation of the National Economic and Development Authority.

The rates of duty herein provided shall apply to all products whether imported directly or indirectly of all foreign countries, which do not discriminate against Philippine export products. An additional 100% across-the-board duty shall be levied on the products of any foreign country which discriminates against Philippine export products.

The tariff schedules, chapters, headings and subheadings and the rate of import duty under Section One Hundred Four of this Code shall be as follows:

[INSERT SCHEDULE HERE]

ANNEX

Headings and Subheadings Covered by Special Provisions

PART I

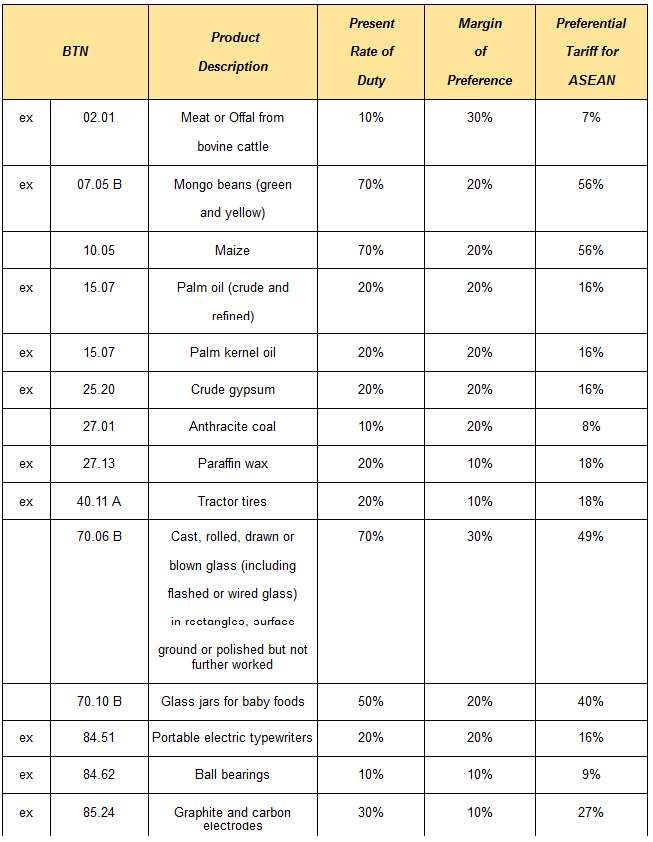

Modifying the Rates of Import Duty on Certain Imported Articles as Provided Under Republic Act No. 1937, Otherwise Known as the Tariff and Customs Code of the Philippines, as Amended, in Order to Implement the Margins of Tariff Preference in Accordance with the ASEAN Agreement on Preferential Trading Arrangements with Respect to Certain Articles Negotiated During the Fourth Meeting of the ASEAN Committee on Trade and Tourism.

Pursuant to the powers vested in me by Section 402 of Republic Act No. 1937, as amended, I, FERDINAND E. MARCOS, President of the Philippines, do hereby direct and order:

SECTION 1. The articles specifically listed in Annex “A” hereof as classified under Section 104 of Republic Act No. 1937, as amended, shall be accorded the margin of tariff preference as specified in column 4 of said Annex “A” hereof. In effect, such articles shall be subject to the Preferential Tariff for Asean indicated in Column 5 of said Annex A.

SECTION 2. In the event that any subsequent changes are made in the basic Philippine rate of duty on any of the above-mentioned articles such articles shall automatically be accorded the corresponding margins of preference indicated in column 4 of Annex A.

SECTION 3. After the effective date of this Order, all the above-described articles entered or withdrawn from warehouse in the Philippines for consumption shall be subject to the rates of import duty herein prescribed subject to qualification under the Rules of Origin as prescribed in the Agreement on Asean Preferential Trading Arrangements ratified on August 1, 1977.

SECTION 4. This Order shall take effect as of 1 January 1978.

PART II

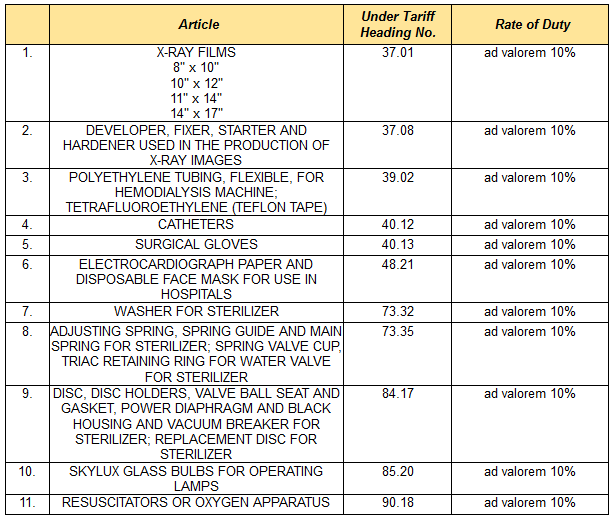

Reducing Under Certain Conditions and for a Limited Period Customs Duties Due on Importations of Certain Hospital/Medical Equipment, Machinery, Implements and Supplies

WHEREAS, the promotion, protection and preservation of the health of the citizenry is the concern of government as ordained in the Constitution;

WHEREAS, hospitals, medical centers and other similar entities play a vital role in maintaining a healthy citizenry so much so that their continued operation should not be hampered by reason of the rise in costs of acquisition of necessary equipment and implements;

WHEREAS, there is a need to provide government assistance to these entities to ensure that their services to the masses, especially to the poorer segment of the citizenry, shall be accorded at least cost and optimum efficacy.

NOW, THEREFORE, I, FERDINAND E. MARCOS, President of the Philippines, by virtue of the powers vested in me by the Constitution do hereby decree and order:

SECTION 1. The provisions of Republic Act No. 1937, as amended, to the contrary notwithstanding, importations by hospitals which are now engaged or shall engage in the treatment and care of the sick of hospital/medical equipment, machinery, implements and supplies as hereinafter enumerated and described shall be subject to customs duties of ten per centum (10%) ad valorem to wit:

SECTION 2. The following articles shall likewise be subject to the reduced rate of duty of 10% ad valorem as soon as their appropriate tariff classification are determined by the Tariff Commission and submitted to the Ministry of Finance:

1. Phosphate Buffer

2. Carbonate/Bicarb Buffer

3. Potassium Ferricyanide

4. Caffeine Diluent

5. Sodium Potassium Tartrate

6. Sulphanilic Acid

7. Working BUN Color

8. Working BUN Acid

9. 4-Aminoantipyrine

10. Sodium Nitrate

11. HCL 0.25N

12. Azoene Fast Red

13. SGPT and Diluent Set

14. Markers for X-ray Equipment

15. Volt complete door, valve triac unit for hemodialysis machine

16. High temperate control, thermistor assembly for sterilizer

17. Indicatory control and recording control for gas sterilizer

18. Door switch, selector switch, pressure switch

19. Resuscitators or oxygen apparatus

20. Vaporizers

21. Mistogen transducer reservoir

SECTION 3. The reduction herein allowed shall only cover importation of hospital/medical equipment, machinery, implements and supplies included in the list above which are directly and actually needed and will be used exclusively in the treatment and care of the sick by the hospital-importer as certified to by the Ministry of Health. Shipping documents covering the importation shall be in the name of the hospital importer to whom the goods shall be directly delivered by customs authorities.

SECTION 4. In addition to the condition in the preceding sections, reduction in duties shall be allowed only to the importation of hospital/medical equipment, machinery, implements and supplies that are not available locally in sufficient quantities and of comparable quality and cost as certified to by the Board of Investments. Further, only hospitals licensed by the Ministry of Health and accredited by the Philippine Medical Care Commission, having at least twenty-five beds and maintaining a ward dispensing free medical services to indigents may qualify for the incentives granted under this Decree.

SECTION 5. Any grantee of the incentives under this Decree who shall make use of the privilege hereunder for purposes other than those for which of this Decree shall be penalized with imprisonment of not less than five (5) years but not exceeding ten (10) years and a fine of not less than P200,000.00 and in addition, such violation shall ipso facto cause forfeiture of the imported articles aside from the payment of all taxes and duties due in accordance with the existing laws.

Any person or any officer or employee of the government who shall connive with the grantee of the reduction in duties in the violation of the provisions of this Decree shall suffer the same penalties prescribed in the first paragraph of this section. In case the grantee is a juridical person, the official or officials who consented to the commission of the offense or tolerated the violation of the provisions of this Decree shall be the person or persons liable.

SECTION 6. Any hospital, medical center, medical clinic or institution who or which may qualify for similar exemption privilege under existing law or other laws hereinafter decreed or enacted and is qualified under this Decree, may choose which privilege the grantee desires to avail of, but in no case shall such grantee be entitled to both privilege simultaneously.

SECTION 7. Rules and regulations to implement the provisions of this Decree shall be prepared by the Ministry of Health within fifteen (15) days from the issuance of this Decree and approved by the Ministry of Finance within another fifteen (15) days.

SECTION 8. All laws, decrees, orders, rules and regulations or parts thereof inconsistent with any of the provisions of this Decree are hereby repealed or modified accordingly.

SECTION 9. This Decree shall take effect upon approval and shall continue to be effective until 31 December 1980.

SECTION 105. Conditionally-Free Importations. — The following articles shall be exempt from the payment of import duties upon compliance with the formalities prescribed in, or with, the regulations which shall be promulgated by the Commissioner of Customs with the approval of the Minister of Finance;Provided, That any article sold, bartered, hired or used for purposes other than that they were intended for without prior payment of the duty, tax or other charges which would have been due and payable at the time of entry if the article had been entered without the benefit of this section, shall be subject to forfeiture and the importation shall constitute a fraudulent practice against customs revenue punishable under Section Thirty-six hundred and two, as amended of this Code: Provided, further, That a sale pursuant to a judicial order or in liquidation of the estate of a deceased person shall not be subject to the preceding proviso, without prejudice to the payment of duties, taxes and other charges: Provided, finally, That the President may, upon recommendation of the Minister of Finance, suspend, disallow or completely withdraw, in whole or in part, any of the conditionally-free importation under this section:

a. Aquatic products (e.g., fish, crustaceans, mollusks, marine animals, seaweeds, fish oil, roe), caught or gathered by fishing vessels of Philippine registry: Provided, That they are imported in such vessels or in crafts attached thereto: And provided, further, That they have not been landed in any foreign territory or, if so landed, they have been landed solely for transhipment without having been advanced in condition;

b. Equipment for use in the salvage of vessels or aircraft, not available locally, upon identification and the giving of a bond in an amount equal to one and one-half times the ascertained duties, taxes and other charges thereon, conditioned for the exportation thereof or payment of the corresponding duties, taxes and other charges within six (6) months from the date of acceptance of the import entry: Provided, That the Collector of Customs may extend the time for exportation or payment of duties, taxes and other charges for a term not exceeding six (6) months from the expiration of the original period;

c. Cost of repairs, excluding the value of the article used, made in foreign countries upon vessels or aircraft documented, registered or licensed in the Philippines, upon proof satisfactory to the Collector of Customs (1) that adequate facilities for such repairs are not afforded in the Philippines, or (2) that such vessels or aircraft, while in the regular course of her voyage or flight was compelled by stress of weather or other casualty to put into a foreign port to make such repairs in order to secure the safety, seaworthiness or airworthiness of the vessel or aircraft to enable her to reach her port of destination;

d. Articles brought into the Philippines for repair, processing or reconditioning to be re-exported upon completion of the repair, processing or reconditioning: Provided, That the Collector of Customs shall require the giving of a bond in an amount equal to one and one-half times the ascertained duties, taxes and other charges thereon, conditioned for the exportation thereof or payment of the corresponding duties, taxes and other charges within six (6) months from the date of acceptance of the import entry;

e. Medals, badges, cups and other small articles bestowed as trophies or prizes, or those received or accepted as honorary distinction;

f. Personal and household effects belonging to residents of the Philippines returning from abroad including jewelry, precious stones and other articles of luxury which were formally declared and listed before departure and identified under oath before the Collector of Customs when exported from the Philippines by such returning residents upon their departure therefrom or during their stay abroad; personal and household effects including wearing apparel, articles of personal adornment (except luxury items), toilet articles, portable appliances and instruments and similar personal effects, excluding vehicles, watercraft, aircraft, and animals, purchased in foreign countries by residents of the Philippines which were necessary, appropriate and normally used for the comfort and convenience in their journey and during their stay abroad upon proof satisfactory to the Collector of Customs that same have been in their use abroad for more than six (6) months and accompanying them on their return, or arriving within a reasonable time which, barring unforeseen circumstances, in no case shall exceed ninety (90) days before or after the owners’ return:Provided, That the personal and household effects shall neither be in commercial quantities nor intended for barter, sale, or hire and that the total dutiable value of which shall not exceed two thousand pesos (P2,000): Provided, further, That the returning resident has not previously received the benefit under this section within one year from and after the last exemption granted: Provided, furthermore, That a fifty (50%) per cent ad valoremduty across the board shall be levied and collected on the personal and household effects (except luxury items) in excess of two thousand pesos (P2,000): And provided, finally, That the personal and household effects (except luxury items) of a returning resident who has not stayed abroad for six (6) months shall be subject to fifty (50%) per cent ad valorem duty across the board, the total dutiable value of which does not exceed two thousand pesos (P2,000); any excess shall be subject to the corresponding duty provided in this Code;

g. Personal and household effects and vehicles accompanying travelers, tourists, foreign consultants and experts hired by, and/or rendering service to, the government and their staff or personnel and families, accompanying or arriving within a reasonable time before or after their arrival in the Philippines, which are necessary and appropriate for the wear or use of such persons according to the nature of the journey, their comfort and convenience: Provided, That this exemption shall not apply to articles intended for other persons or for barter, sale or hire: Provided, further, That the Collector of Customs may, in his discretion, require either a written commitment or a bond in an amount equal to one and one-half times the ascertained duties, taxes and other charges upon articles classified under this sub-section, conditioned for the exportation thereof or payment of the corresponding duties, taxes and other charges within six (6) months from the date of acceptance of the import entry in the case of travelers and tourists; and in the case of foreign consultants and experts and their staff or personnel or families, within six (6) months after the expiration of their term or contract: And Provided, finally, That the Collector of Customs may extend the time for exportation or payment of duties, taxes and other charges for a term not exceeding six (6) months from the expiration of the original period;

h. Professional instruments and implements, tools of trade, occupation or employment, wearing apparel, domestic animals, and personal and household effects belonging to persons coming to settle in the Philippines or Filipinos and/or their families and descendants who are now residents or citizens of other countries, such parties hereinafter referred to as Overseas Filipinos, in quantities and of the class suitable to the profession, rank or position of the persons importing them, for their own use and not for barter or sale, accompanying such persons, or arriving within a reasonable time, in the discretion of the Collector of Customs, before or after the arrival of their owners, which shall not be later than February 28, 1979 upon the production of evidence satisfactory to the Collector of Customs that such persons are actually coming to settle in the Philippines, that change of residence was bona fide and that the privilege of free entry was never granted to them before or that such person qualifies under the provisions of Letters of Instructions 105, 163 and 210, and that the articles are brought from their former place of abode, shall be exempt from the payment of customs duties and taxes: Provided, That vehicles, vessels, aircraft, machineries and other similar articles for use in manufacture, shall not be classified hereunder.

i. Articles used exclusively for public entertainment, and for display in public expositions, or for exhibition or competition for prizes, and devices for projecting pictures and parts and appurtenances thereof, upon identification, examination and appraisal and the giving of a bond in an amount equal to one and one-half times the ascertained duties, taxes and other charges thereon, conditioned for exportation thereof or payment of the corresponding duties, taxes and other charges within six (6) months from the date of acceptance of the import entry; Provided, That the Collector of Customs may extend the time for exportation or payment of duties, taxes and other charges for a term not exceeding six (6) months from the expiration of the original period; and technical and scientific films when imported by technical, cultural and scientific institutions, and not to be exhibited for profit: Provided, further, That if any of the said films is exhibited for profit, the proceeds therefrom shall be subject to confiscation, in addition to the penalty provided under Section Thirty-six hundred and ten as amended, of this Code;

j. Articles brought by foreign film producers directly and exclusively used for making or recording motion picture films on location in the Philippines, upon their identification, examination and appraisal and the giving of a bond in an amount equal to one and one-half times the ascertained duties, taxes and other charges thereon, conditioned for exportation thereof or payment of the corresponding duties, taxes and other charges within six (6) months from the date of acceptance of the import entry, unless extended by the Collector of Customs for another six (6) months;

Photographic and cinematographic films, undeveloped, exposed outside the Philippines by resident Filipino citizens or by producing companies of Philippine registry where the principal actors and artists employed for the production are Filipinos, upon affidavit by the importer and identification that such exposed films are the same films previously exported from the Philippines. As used in this paragraph, the terms “actors” and “artists” include the persons operating the photographic camera or other photographic and sound recording apparatus by which the film is made;

k. Importations for the official use of foreign embassies, legations, and other agencies of foreign governments: Provided, That those foreign countries accord like privileges to corresponding agencies of the Philippines.

Articles imported for the personal or family use of the members and attachés of foreign embassies, legations, consular officers and other representatives of foreign governments: Provided, That such privilege shall be accorded under special agreements between the Philippines and the countries which they represent: And Provided, further, That the privilege may be granted only upon specific instructions of the Minister of Finance in each instance which will be issued only upon request of the Ministry of Foreign Affairs;

l. Imported articles donated to, or for the account of, any duly registered relief organization, not operated for profit, for free distribution among the needy, upon certification by the Ministry of Social Services and Development or the Ministry of Education and Culture, as the case may be;

m. Containers, holders and other similar receptacles of any material including kraft paper bags for locally manufactured cement for export, including corrugated boxes for bananas, mangoes, pineapples and other fresh fruits for export, except other containers made of paper, paperboard and textile fabrics, which are of such character as to be readily identifiable and/or reusable for shipment or transportation of goods shall be delivered to the importer thereof upon identification, examination and appraisal and the giving of a bond in an amount equal to one and one-half times the ascertained duties, taxes and other charges within six (6) months from the date of acceptance of the import entry.

n. Supplies which are necessary for the reasonable requirements of the vessel or aircraft in her voyage or flight outside the Philippines, including articles transferred from a bonded warehouse in any collection district to any vessel or aircraft engaged in foreign trade, for use or consumption of the passengers or its crew on board such vessel or aircraft as sea or air stores; or articles purchased abroad for sale on board a vessel or aircraft as saloon stores or air store supplies: Provided, That any surplus or excess of such vessel or aircraft supplies arriving from foreign ports or airports shall be dutiable;

o. Articles and salvage from vessels recovered after a period of two (2) years from the date of filing the marine protest or the time when the vessel was wrecked or abandoned, or parts of a foreign vessel or her equipment, wrecked or abandoned in Philippine waters or elsewhere: Provided, That articles and salvage recovered within the said period of two (2) years shall be dutiable;

p. Coffins or urns containing human remains, bones or ashes, used personal and household effects (not merchandise) of the deceased person, except vehicles, the value of which does not exceed ten thousand pesos (P10,000) upon identification as such;

q. Samples of the kind, in such quantity and of such dimension or construction as to render them unsalable or of no appreciable commercial value; models not adapted for practical use; and samples of medicines, properly marked “sample-sale punishable by law”, for the purpose of introducing a new article in the Philippine market and imported only once in a quantity sufficient for such purpose by a person duly registered and identified to be engaged in that trade: Provided, That importations under this subsection shall be previously authorized by the Minister of Finance: Provided, however, That importation of sample medicine shall be previously authorized by the Minister of Health that such samples are new medicines not available in the Philippines: Provided, finally, That samples not previously authorized and or properly marked in accordance with this section shall be levied the corresponding tariff duty.

Commercial samples, except those that are not readily and easily identifiable (e.g., precious and semi-precious stones, cut or uncut, and jewelry set with precious or semi-precious stones), the value of any single importation of which does not exceed ten thousand pesos (P10,000) upon the giving of a bond in an amount equal to twice the ascertained duties, taxes and other charges thereon, conditioned for the exportation of said samples within six (6) months from the date of the acceptance of the import entry or in default thereof, the payment of the corresponding duties, taxes and other charges. If the value of any single consignment of such commercial samples exceeds ten thousand pesos (P10,000), the importer thereof may select any portion of same not exceeding in value ten thousand pesos (P10,000) for entry under the provisions of this subsection, and the excess of the consignment may be entered in bond, or for consumption, as the importer may elect;

r. Animals (except race horses), and plants for scientific, experimental, propagation, botanical, breeding, zoological and national defense purposes:Provided, That no live trees, shoots, plants, moss, and bulbs, tubers and seeds for propagation purposes may be imported under this section, except by order of the Government or other duly authorized institutions: Provided, further, That the free entry of animals for breeding purposes shall be restricted to animals of recognized breed, duly registered in the book of record established for that breed, certified as such by the Bureau of Animal Industry: Provided, furthermore, That certificate of such record, and pedigree of such animal duly authenticated by the proper custodian of such book of record, shall be produced and submitted to the Collector of Customs, together with affidavit of the owner or importer, that such animal is the animal described in said certificate of record and pedigree: And Provided, finally, That the animals and plants are certified by the National Economic and Development Authority as necessary for economic development;

s. Economic, technical, vocational, scientific, philosophical, historical, and cultural books and/or publications: Provided, That those which may have already been imported but pending release by the Bureau of Customs at the effectivity of this Decree may still enjoy the privilege herein provided upon certification by the Ministry of Education and Culture that such imported books and/or publications are for economic, technical, vocational, scientific, philosophical, historical or cultural purposes or that the same are educational, scientific or cultural materials covered by the International Agreement on Importation of Educational, Scientific and Cultural Materials signed by the President of the Philippines on August 2, 1952, or other agreements binding upon the Philippines.

Educational, scientific and cultural materials covered by international agreements or commitments binding upon the Philippine Government so certified by the Ministry of Education and Culture.

Bibles, missals, prayer books, Koran, Ahadith and other religious books of similar nature and extracts therefrom, hymnal and hymns for religious uses.

t. Philippine articles previously exported from the Philippines and returned without having been advanced in value or improved in condition by any process of manufacture or other means, and upon which no drawback or bounty has been allowed, including instruments and implements, tools of trade, machinery and equipment, used abroad by Filipino citizens in the pursuit of their business, occupation or profession; and foreign articles previously imported when returned after having been exported and loaned for use temporarily abroad solely for exhibition, testing or experimentation, for scientific or educational purposes; and foreign containers previously imported which have been used in packing exported Philippine articles and returned empty if imported by or for the account of the person or institution who exported them from the Philippines and not for sale, barter or hire subject to identification: Provided, That any Philippine article falling under this subsection upon which drawback or bounty has been allowed shall, upon re-importation thereof, be subject to a duty under this subsection equal to the amount of such drawback or bounty;

u. Aircraft, equipment and machinery, spare parts commissary and catering supplies, aviation gas, fuel and oil, whether crude or refined, and such other articles or supplies imported by and for the use of scheduled airlines operating under Congressional franchise: Provided, That such articles or supplies are not locally available in reasonable quantity, quality and price and are necessary or incidental for the proper operation of the schedule airline importing the same;

v. Machineries, equipment, tools for production, plants to convert mineral ores into saleable form, spare parts, supplies, materials, accessories, explosives, chemicals, and transportation and communication facilities imported by and for the use of new mines and old mines which resume operations, when certified to as such by the Minister of Agriculture and Natural Resources upon the recommendation of the Director of Mines, for a period ending five (5) years from the first date of actual commercial production of saleable mineral products: Provided, That such articles are not locally available in reasonable quantity, quality and price and are necessary or incidental in the proper operation of the mine; and aircrafts imported by agro-industrial companies to be used by them in their agriculture and industrial operations or activities, spare parts and accessories thereof;

w. Spare parts of vessels or aircraft of foreign registry engaged in foreign trade when brought into the Philippines exclusively as replacements or for the emergency repair thereof, upon proof satisfactory to the Collector of Customs that such spare parts shall be utilized to secure the safety, sea-worthiness or air-worthiness of the vessel or aircraft, to enable it to continue its voyage or flight;

x. Articles of easy identification exported from the Philippines for repair and subsequently re-imported upon proof satisfactory to the Collector of Customs that such article is not capable of being repaired locally: Provided, That the cost of the repairs made to any such article shall pay a rate of duty of thirty per cent ad valorem;

y. Trailer chassis when imported by shipping companies for their exclusive use in handling containerized cargo, upon posting a bond in an amount equal to one and one-half times the ascertained duties, taxes and other charges due thereon to cover a period of one year from the date of acceptance of the entry, which period for meritorious reasons may be extended by the Commissioner of Customs for another year, subject to the following conditions:

1. That they shall be properly identified and registered with the Land Transportation Commission;

2. That they shall be subject to customs supervision fee to be fixed by the Collector of Customs and subject to the approval of the Commissioner of Customs;

3. That they shall be deposited in the Customs zone when not in use; and

4. That upon the expiration of the period prescribed above, duties and taxes shall be paid, unless otherwise re-exported.

The provisions of Sec. 105 of Presidential Decree No. 34, dated October 27, 1972, to the contrary nothwithstanding, any officer or employee of the Ministry of Foreign Affairs, including any attache, civil or military, or member of his staff assigned to a Philippine diplomatic mission abroad by his Ministry or any similar officer or employee assigned to a Philippine consular office abroad, or any personnel of the Reparations Mission in Tokyo, or AFP military personnel detailed with SEATO or any AFP military personnel accorded assimilated diplomatic rank on duty abroad who is returning from a regular assignment abroad, for reassignment to his Home office, or who dies, resigns, or is retired from the service, after the approval of this Decree, shall be exempt from the payment of all duties and taxes on his personal and household effects, including one motor car which must have been ordered or purchased prior to the receipt by the mission or consulate of his order of recall, and which must be registered in his name: Provided, however, That this exemption shall apply only to the value of the motor car and to the aggregate assessed value of said personal and household effects the latter not to exceed thirty per centum (30%) of the total amount received by such officer or employee in salary and allowances during his latest assignment abroad but not to exceed four years: Provided, further, That this exemption shall not be availed of oftener than once every four years: And, Provided, finally, That the officer or employee concerned must have served abroad for not less than two years.

The provisions of general and special laws, including those granting franchises, to the contrary notwithstanding, there shall be no exemptions whatsoever from the payment of customs duties except those provided for in this Code; those granted to government agencies, instrumentalities or government-owned or controlled corporations with existing contracts, commitments, agreements, or obligations (requiring such exemption) with foreign countries; international institutions, associations or organizations entitled to exemption pursuant to agreements or special laws; and those that may be granted by the President upon prior recommendation of the National Economic and Development Authority in the interest of national economic development.

SECTION 106. Drawbacks. —

(a) On Fuel Used for Propulsion of Vessels. — On all fuel imported into the Philippines used for propulsion of vessels engaged in trade with foreign countries, or in the coastwise trade, a refund or tax credit shall be allowed not exceeding ninety-nine (99) per cent of the duty imposed by law upon such fuel, which shall be paid or credited under such rules and regulations as may be prescribed by the Commissioner of Customs with the approval of the Minister of Finance.

(b) On Petroleum Oils and Oils Obtained from Bituminous Minerals, Crude Eventually Used for Generation of Electric Power and for the Manufacture of City Gas. — On petroleum oils and oils obtained from bituminous materials, crude oils imported by non-electric utilities, sold directly or indirectly, in the same form or after processing, to electric utilities for the generation of electric power and for the manufacture of city gas, a refund or tax credit shall be allowed not exceeding fifty per cent (50%) of the duty imposed by law upon such oils, which shall be paid or credited under such rules and regulations as may be prescribed by the Commissioner of Customs with the approval of the Minister of Finance.

(c) On Articles Made from Imported Materials. — Upon exportation of articles manufactured or produced in the Philippines, including the packing, covering, putting up, marking or labeling thereof either in whole or in part of imported materials for which duties have been paid, refund or tax credit shall be allowed for the duties paid on the imported materials so used including the packing, covering, putting up, marking or labeling thereof, subject to the following conditions:

1. The actual use of the imported materials in the production or manufacture of the article exported with their quantity, value, and amount of duties paid thereon, having been established;

2. The duties refunded or credited shall not exceed ninety-nine (99) per cent of duties paid on the imported materials used;

3. There are no available locally produced or manufactured competitive substitutes for the imported materials used at the time of importation as certified by the National Economic and Development Authority;

4. The exportation shall be made within one (1) year after the importation of materials used and the claim for refund or the credit shall be filed within one (1) year from date of exportation;

5. When two or more products result from the use of the same imported materials, an apportionment shall be made on its equitable basis.

(d) Payment of Partial Drawbacks. — The Minister of Finance may, upon recommendation of the Commissioner of Customs, promulgate rules and regulations allowing partial payments of drawbacks under this section.

(e) Payment of the Drawbacks. — Claims for refund or tax credit eligible for such benefits shall be paid or granted by the Bureau of Customs to claimants within sixty (60) days after receipt of properly accomplished claims: Provided, That a registered enterprise under Republic Act Numbered Fifty-one hundred and eighty-six or Republic Act Numbered Sixty-one hundred and thirty-five which has previously enjoyed tax credit based on customs duties paid on imported raw materials and supplies, shall not be entitled to drawback under this section, with respect to the same importation subsequently processed and re-exported:Provided, further, That if as a result of the refund or tax credit by way of drawback of customs duties, there would necessarily result a corresponding refund or credit of internal revenue taxes on the same importation, the Collector of Customs shall likewise certify the same to the Commissioner of Customs who shall cause the said refund or tax credit of internal revenue taxes to be paid, refunded or credited in favor of the importer, with advice to the Commissioner of Internal Revenue.

TITLE II

Administrative Provisions

PART 1

Bases of Assessment of Duty

SECTION 201. Basis of Dutiable Value. — The dutiable value of an imported article subject to an ad valorem rate of duty shall be based on the home consumption value or price (excluding internal excise taxes) of same, like or similar articles, as bought and sold or offered for sale freely in the usual wholesale quantities in the ordinary course of trade, in the principal markets of the country from where exported on the date of exportation to the Philippines, or where there is none on such date, then on the home consumption value or price nearest to the date of exportation including the value of all containers, coverings and/or packings of any kind and all other costs, charges and expenses incident to placing the article in a condition ready for shipment to the Philippines, plus ten (10) per cent of such home consumption value or price.

The home consumption value or price under this section shall be the value or price declared in the consular, commercial, trade or sales invoice. Where there exists a reasonable doubt as to the value or price of the imported article declared in the entry, the correct dutiable value of the article shall be ascertained from the reports of the Revenue Attachè or Commercial Attachè (Foreign Trade Promotion Attachè), pursuant to Republic Act Numbered Fifty-four hundred and sixty-six or other Philippine diplomatic officers and from such other information that may be available to the Bureau of Customs.

From the data thus gathered, the Commissioner of Customs shall ascertain and establish the home consumption values of articles exported to the Philippines and shall publish such lists of values from time to time.

When the dutiable value provided for in the preceding paragraphs cannot be ascertained for failure of the importer to produce the documents mentioned in the second paragraph, or where there exists a reasonable doubt as to dutiable value of the imported article declared in the entry, it shall be the domestic wholesale selling price of such or similar article in Manila or other principal markets in the Philippines on the date the duty becomes payable on the article under appraisement, on the usual wholesale quantities and in the ordinary course of trade, minus —

(a) Twenty (20) per cent thereof for expenses and profits; and

(b) Duties and taxes paid thereon.

SECTION 202. Bases of Dutiable Weight. — On articles that are subject to specific rate of duty, based on weight, the duty shall be ascertained as follows:

a. When articles are dutiable by the gross weight, the dutiable weight thereof shall be the weight of same, together with the weight of all containers, packages, holders and packing, of any kind, in which said articles are contained, held or packed at the time of importation.

b. When articles are dutiable by the legal weight, the dutiable weight thereof shall be the weight of same, together with the weight of the immediate containers, holders and/or packing in which such articles are usually contained, held or packed at the time of importation and/or, when imported in retail packages, at the time of their sale to the public in usual retail quantities: Provided, That when articles are packed in single container, the weight of the latter shall be included in the legal weight.

c. When articles are dutiable by the net weight, the dutiable weight thereof shall be only the actual weight of the articles at the time of importation, excluding the weight of the immediate and all other containers, holders or packing in which such articles are contained, held or packed.

d. Articles affixed to cardboard, cards, paper, wood or similar common material shall be dutiable together with the weight of such holders.

e. When a single package contains imported articles dutiable according to different weights, or to weight and value, the common exterior receptacles shall be prorated and the different proportions thereof treated in accordance with the provisions of this Code as to the dutiability or non-dutiability of such packing.

SECTION 203. General Rules of Classification. — The interpretation and application of the provisions of this Code relating to the classification of articles imported into the Philippines shall be governed by the following principles:

RULE 1. The titles of schedules, chapters, and subschapters are provided for ease of reference only; for legal purposes, classification shall be determined according to the terms of the headings or subheadings and any relative schedule or chapter notes and, provided, such headings, or sub-headings or notes do not otherwise require, according to the succeeding rules.

RULE 2. a. Any reference in a heading to an article shall be taken to include a reference to that article incomplete or unfinished, provided that, as imported, the incomplete or unfinished, articles has the essential character of the complete or finished article. It shall also be taken to include a reference to that article complete or finished (or falling to be classified as complete or finished by virtue of this rule), imported unassembled or disassembled.

b Any reference in a heading or subheading to a material or substance shall include a reference to mixtures or combinations of that material or substance with other materials or substances. Any reference to articles of a given material or substance shall include a reference to articles consisting wholly or partly of such material or substance. The classification of articles consisting of more than one material or substance shall be according to the principles of Rule 3.

RULE 3. When articles are prima facie, classifiable under two or more headings or subheadings, or imported in sets consisting of several articles, classification shall be effected as follows:

a. The heading or subheading which provides the most specific description shall be preferred to any other heading or subheading providing a more general description.

b. Mixtures and composite articles which consist of different materials or are made up of different components and which cannot be classified by reference to “3a” shall be classified as if they consisted of the material or component which gives the articles their essential character, insofar as this criterion is applicable.

c. When articles cannot be classified by reference to “3a” or “3b” they shall be classified under the heading or subheading which provides the highest rate of duty.

RULE 4. Articles not falling within any heading or subheading of this Code shall be classified under the heading or subheading appropriate to articles to which they are most akin.

SECTION 204. Rate of Exchange. — For the assessment and collection of import duty upon imported articles and for other purposes, the value and prices thereof quoted in foreign currency shall be converted into the currency of the Philippines at the current rate of exchange or value specified or published, from time to time, by the Central Bank of the Philippines.

SECTION 205. Effective Date of Rates Import Duty. — Imported articles shall be subject to the rate or rates of import duty existing at the time of entry, or withdrawal from warehouse, in the Philippines, for consumption.

On and after the day when this Code shall go into effect, all articles previously imported, for which no entry has been made, and all articles previously entered without payment of duty and under bond for warehousing, transportation, or any other purpose, for which no permit of delivery to the importer or his agent has been issued, shall be subject to the rates of duty imposed by this Code and to no other duty, upon the entry, or withdrawal thereof from warehouse, for consumption.

On articles abandoned or forefeited to, or seized by, the government, and then sold at public auction, the rates of duty and the tariff in force on the date of the auction shall apply: Provided, That duty based on the weight, volume and quantity of articles shall be levied and collected on the weight, volume and quantity at the time of their entry into the warehouse or the date of abandonment, forfeiture and/or seizure.

SECTION 206. Entry, or Withdrawal from Warehouse, for Consumption. — Imported articles shall be deemed “entered” in the Philippines for consumption when the specified entry form is properly filed and accepted, together with any related documents required by the provisions of this Code and/or regulations to be filed with such form at the time of entry, at the port or station by the customs official designated to receive such entry papers and any duties, taxes, fees and/or other lawful charges required to be paid at the time of making such entry have been paid or secured to be paid with the customs official designated to receive such monies, provided that the article has previously arrived within the limits of the port of entry.

Imported articles shall be deemed “withdrawn” from warehouse in the Philippines for consumption when the specified form is properly filed and accepted, together with any related documents required by any provisions of this Code and/or regulations to be filed with such form at the time of withdrawal, by the customs official designated to receive the withdrawal entry and any duties, taxes, fees and/or other lawful charges required to be paid at the time of withdrawal have been deposited with the customs official designated to receive such payment.

PART 2

Special Duties

SECTION 301. Dumping Duty. —

a. Whenever the Minister of Finance (hereinafter called the “Minister”) has reason to believe, from invoices or other documents or newspapers, magazines or information made available by any government agency or interested party, that a specific kind or class of foreign article, is being imported into, or sold or is likely to be sold in the Philippines, at a price less than its fair value, the importation or sale of which might injure, or retard the establishment of, or is likely to injure, an industry producing like goods in the Philippines, he shall so advise the Tariff Commission (hereinafter called the “Commission”), and shall instruct the Collector of Customs to require an anti-dumping bond of twice the dutiable value of the imported article coming from the specific country.

b. The Commission, upon receipt of such advice from the Minister shall conduct an investigation to:

1. Verify if the kind or class of article in question is being imported into, or sold or is likely to be sold in, the Philippines at a price less than its fair value;

2. Determine if, as a result thereof, an industry producing like goods in the Philippines is being injured or is likely to be injured or is retarded from being established by reason of the importation or sale of that kind or class of article into the Philippines. Provided, That a finding that an article is being imported into the Philippines at a price less than its fair value shall be deemed prima facie proof of injury, or retarding the establishment of an industry producing like goods in the Philippines: And provided, further, That in determining whether the domestic industry has suffered or is being threatened with injury, the Commission shall determine whether the wholesale prices at which the domestic products are sold are reasonable, taking into account the cost of raw materials, labor, overhead, a fair return on investment and the overall efficiency of the industry; and

3. Ascertain the difference, if any, between the purchase price and the fair value of the article. The Commission shall submit its findings to the Minister within one month after the termination of the public hearing.

c. The Minister shall, after receipt of the report of Commission, decide whether the article in question is being imported in violation of this section and shall give due notice of such decision and shall direct the Commissioner of Customs to cause the dumping duty, to be levied, collected and paid, as prescribed in this section, in addition to any other duties, taxes and charges imposed by law on such article, and on the articles of the same specific kind or class subsequently imported under similar circumstances coming from the specific country.

d. The “Dumping duty” as provided for in subsection “c” hereof shall be equal to the difference between the actual purchase price and the fair value of the article as determined in the dumping decision. However, in cases of subsequent importations of same kind or class of article from the specific country named in the protest, the dumping duty shall be equal to the difference between the actual purchase price and the fair value actually existing at the time of importation as determined by the Tariff Commission from the supporting documents submitted or from other reliable sources.

e. Pending investigation and final decision of the case, the article in question, and articles of the same specific kind or class subsequently imported under similar circumstances, shall be released to the owner, importer, consignee or agent upon the giving of a bond in an amount equal to twice the estimated dutiable value thereof.

f. Any aggrieved party may appeal only the amount of the dumping duty to the Court of Tax Appeals in the same manner and within the same period provided for by law in the case of appeal from decision of the Commissioner of Customs.

g. (1) The article, if it has not been previously released under bond as provided for in subsection “e” hereof, shall be released after payment by the party concerned of the corresponding dumping duty in addition to any ordinary duties, taxes, and charges, if any, or re-exported by the owner, importer, consignee or agent, at his option and expense, upon the filing of a bond in an amount equal to twice the estimated dutiable value of the article, conditioned upon presentation of landing certificate issued by a consular officer of the Philippines at the country of destination; or

(2) If the article has been previously released under bond, as provided in subsection “e” hereof, the party concerned shall be required to pay the corresponding dumping duty in addition to any ordinary duties, taxes and charges, if any.

h. Any investigation to be conducted by the Commission under this section shall include a public hearing or hearings where the owner, importer, consignee or agent of the imported article, the local producers of a like article, other parties directly affected, and such other parties as in the judgment of the Commission are entitled to appear, shall be given an opportunity to be heard and to present evidence bearing on the subject matter.

i. The established dumping duty shall be subject to adjustment based on the prevailing home consumption price or in the absence thereof, the cost of production. The Commission shall conduct quarterly examination and/or verification of the fair value to determine the necessity of adjustment. Should the Minister, upon receipt of the report of the Commission, find that there is a need for an adjustment he shall direct the Commissioner of Customs to effect the necessary adjustment in dumping duty.

The Philippine Finance Attachè or, in the absence thereof, the Commercial Attachè or, in the absence thereof, the diplomatic officer and/or consular officer abroad shall be advised by the Minister of any article covered by dumping decision. The concerned Attachè or the Officer shall submit quarterly report on home consumption prices, or in the absence thereof, the cost of production, of said articles to the Minister and the Commission, thru the department head.

j. Whenever the Commission, on its own motion or upon application of any interested party, finds that any of the conditions which necessitated the imposition of the dumping duty has ceased to exist, it shall submit the necessary recommendation to the Minister for the discontinuance or modification of such dumping duty. Any decision or order made under this section by the Minister shall be published in the Official Gazette and/or in a newspaper of general circulation.

k. Any dumping decision promulgated by the Minister shall be effective for a period of five years from the time of its promulgation except upon the representation of the interested party of the necessity to continue the implementation of said decision, in which case the Minister shall advise the Commission to conduct an investigation to determine whether the conditions in paragraph b-1 and b-2 still exist. The action for extension shall be brought before the Minister at least six (6) months before the expiration of the period.

The findings of the Commission shall be submitted to the Minister at least three (3) months before the expiration of the period.

All industries protected by any dumping decision for five years or more from the time of its promulgation may apply for extension to the Minister within six (6) months from effectivity of this decree. The decision shall be deemed terminated upon failure to file the application within the period so provided.

l. The Minister and the Commission shall promulgate all rules and regulations necessary to carry out their respective functions under this section.

SECTION 302. Countervailing Duty. —

a. Whenever any article is directly or indirectly granted any bounty, subsidy or subvention upon its production, manufacture or exportation in the country of origin and/or exportation, and, the importation of which has been determined by the Minister, after investigation and report of the Commission, there shall be levied a countervailing duty equal to the ascertained or estimated amount of such bounty, subsidy or subvention: Provided, That the exemption of any exported article from duty or tax imposed on like articles when destined for consumption in the country of origin and/or exportation, or the refunding of such duty or tax, shall not be deemed to constitute a grant of a bounty, subsidy or subvention within the meaning of this section: Provided, further, That should an article be allowed drawback by the country of origin and/or exportation, only the ascertained or estimated excess of the amount of the drawback over the total amount of the duties and/or internal taxes, if any, shall constitute a bounty, subsidy or subvention: Provided, finally, That petitions for imposition of countervailing duty shall be filed with the Minister of Finance. Upon finding of a prima facie case of bounty, subsidy or subvention enjoyed by the imported article, the Minister shall refer the case to the Tariff Commission for investigation and shall instruct the Commissioner of Customs to require the filing of countervailing bonds for importations entered during the pendency of countervailing proceedings.

b. The Minister shall, after receipt of the reports of the Commission, decide whether the article in question is granted any bounty, subsidy or subvention and if so, fix the countervailing duty equal to the ascertained or estimated bounty, subsidy or subvention. He shall give due notice of his decision and shall direct the Commissioner of Customs to cause the countervailing duty to be levied, collected and paid in addition to any ordinary duties, taxes and charges imposed by law on such article and on articles of the same specific kind or class subsequently imported under similar circumstances;

c. Pending investigation and final decision of the case, the article in question shall not be released from customs custody to the owner except upon the filing of a bond twice the amount of the dutiable value thereof;

d. The article, if not previously released under bond as provided for in this section, shall be released after payment by the party concerned of the corresponding countervailing duty in addition to any ordinary duties, taxes and charges, if any, or re-exported upon the filing of a bond in an amount twice the estimated dutiable value of the article, conditioned upon the presentation of a landing certificate issued by a consular officer of the Philippines at the country of destination. If the article has been previously released under bond, the party concerned shall be required to pay the corresponding countervailing duty in addition to ordinary duties, taxes and other charges, if any;

e. Whenever the Commission, on its own motion or upon application of any interested party finds that the condition which necessitated the imposition of the countervailing duty has ceased to exist, it shall submit the necessary recommendations to the Minister for the discontinuance of the imposition of that duty. Any order made under this section by the Minister shall be published in the Official Gazette and/or in a newspaper of general circulation;

f. Any countervailing decision rendered 5 years or more from the time of the promulgation of this decree shall be deemed terminated unless it can be shown by the parties concerned that there still exists a bounty, subsidy or subvention upon the production, manufacture or exportation of like goods in the Philippines; and

g. The Minister and the Commission shall promulgate all rules and regulations necessary to carry out their respective functions under this section.

SECTION 303. Marking of Imported Articles and Containers. —

a. Marking of Articles. — Except as hereinafter provided, every article of foreign origin (or its container, as provided in subsection “b” hereof) imported into the Philippines shall be marked in any official language of the Philippines and in a conspicuous place as legibly, indelibly and permanently as the nature of the article (or container) will permit in such manner as to indicate to an ultimate purchaser in the Philippines the name of the country of origin of the article. The Commissioner of Customs shall, with the approval of the department head, issue rules and regulations to —

(1) Determine the character of words and phrases or abbreviation thereof which shall be acceptable as indicating the country of origin and prescribe any reasonable method of marking, whether by printing, stenciling, stamping, branding, labeling or by any other reasonable method, and a conspicuous place on the article or container where the marking shall appear.

(2) Require the addition of any other words or symbols which may be appropriate to prevent deception or mistake as to the origin of the article or as to the origin of any other article with which such imported article is usually combined subsequent to importation but before delivery to an ultimate purchaser; and

(3) Authorize the exception of any article from the requirements of marking if —

(a) Such article is incapable of being marked;

(b) Such article cannot be marked prior to shipment to the Philippines without injury;

(c) Such article cannot be marked prior to shipment to the Philippines, except at an expense economically prohibitive of its importation;

(d) The marking of a container of such article will reasonably indicate the origin of such article;

(e) Such article is a crude substance;

(f) Such article is imported for use by the importer and not intended for sale in its imported or any other form;

(g) Such article is to be processed in the Philippines by the importer or for his account otherwise than for the purpose of concealing the origin of such article and in such manner that any mark contemplated by this section would necessarily be obliterated, destroyed or permanently concealed;

(h) An ultimate purchaser, by reason of the character of such article or by reason of the circumstances of its importation must necessarily know the country of origin of such article even though it is not marked to indicate its origin;

(i) Such article was produced more than twenty years prior to its importation into the Philippines; or

(j) Such article cannot be marked after importation except at an expense which is economically prohibitive, and the failure to mark the article before importation was not due to any purpose of the importer, producer, seller or shipper to avoid compliance with this section.

b. Marking of Containers. — Whenever an article is excepted under subdivision (3) of subsection “a” of this section from the requirements of marking, the immediate container, if any, of such article, or such other container or containers of such article as may be prescribed by the Commissioner of Customs with the approval of the department head, shall be marked in such manner as to indicate to an ultimate purchaser in the Philippines the name of the country of origin of such article in any official language of the Philippines, subject to all provisions of this section, including the same exceptions as are applicable to articles under subdivision (3) of subsection “a”.

c. Marking Duty for Failure to Mark. — If at the time of importation any article (or its container, as provided in subsection “b” hereof), is not marked in accordance with the requirements of this section, there shall be levied, collected and paid upon such article a marking duty of 5 per cent ad valorem, which shall be deemed to have accrued at the time of importation, except when such article is exported or destroyed under customs supervision and prior to the final liquidation of the corresponding entry.

d. Delivery Withheld until Marked. — No imported article held in customs custody for inspection, examination or appraisement shall be delivered until such article and/or its containers, whether released or not from customs custody, shall have been marked in accordance with the requirements of this section and until the amount of duty estimated to be payable under subsection “c” of this section shall have been deposited. Nothing in this section shall be construed as excepting any article or its container from the particular requirements of marking provided for in any provision of law.

e. The failure or refusal of the owner or importer to mark the articles as herein required within a period of thirty days after due notice shall constitute as an act of abandonment of said articles and their disposition shall be governed by the provisions of this Code relative to abandonment of imported articles.

SECTION 304. Discrimination by Foreign Countries. —

a. The President, when he finds that the public interest will be served thereby, shall by proclamation specify and declare new or additional duties in an amount not exceeding one hundred (100%) per cent ad valorem upon articles wholly or in part the growth or product of, or imported in a vessel of, any foreign country whenever he shall find as a fact that such country —

(1) Imposes, directly or indirectly, upon the disposition or transportation in transit through or re-exportation from such country of any article wholly or in part the growth or product of the Philippines, any unreasonable charge, exaction regulation or limitation which is not equally enforced upon the like articles of every foreign country; or

(2) Discriminates in fact against the commerce of the Philippines, directly or indirectly, by law or administrative regulation or practice, by or in respect to any customs, tonnage, or port duty, fee, charge, exaction, classification, regulation, condition, restriction or prohibition, in such manner as to place the commerce of the Philippines at a disadvantage compared with the commerce of any foreign country.

b. If at any time the President shall find it to be a fact that any foreign country has not only discriminated against the commerce of the Philippines, as aforesaid, but has, after the issuance of a proclamation as authorized in subsection “a” of this section, maintained or increased its said discrimination against the commerce of the Philippines, the President is hereby authorized, if he deems it consistent with the interests of the Philippines, to issue a further proclamation directing that such product of said country or such articles imported in its vessels as he shall deem consistent with the public interests, shall be excluded from importation into the Philippines.

c. Any proclamation issued by the President under this section shall, if he deems it consistent with the interests of the Philippines, extend to the whole of any foreign country or may be confined to any subdivision or subdivisions thereof; and the President shall, whenever he deems the public interests require, suspend, revoke, supplement or amend any such proclamation.

d. All articles imported contrary to the provisions of this section shall be forfeited to the Government of the Philippines and shall be liable to be seized, prosecuted and condemned in like manner and under the same regulations, restrictions and provisions as may from time to time be established for the recovery, collection, distribution and remission of forfeiture to the government by the tariff and customs laws. Whenever the provision of this section shall be applicable to importation into the Philippines of articles wholly or in part the growth or product of any foreign country, they shall be applicable thereto, whether such articles are imported directly or indirectly.

e. It shall be the duty of the Commission to ascertain and at all times to be informed whether any of the discriminations against the commerce of the Philippines enumerated in subsections “a” and “b” of this section are practiced by any country; and if and when such discriminatory acts are disclosed, it shall be the duty of the Commission to bring the matter to the attention of the President, together with recommendations.

f. The Minister of Finance shall make such rules and regulations as are necessary for the execution of such proclamation as the President may issue in accordance with the provisions of this section.

PART 3

Flexible Tariff

SECTION 401. Flexible Clause. —

a. In the interest of national economy, general welfare and/or national security, and subject to the limitations herein prescribed, the President, upon recommendation of the National Economic and Development Authority (hereinafter referred to as NEDA), is hereby empowered: (1) to increase, reduce or remove existing protective rates of import duty (including any necessary change in classification). The existing rates may be increased or decreased but in no case shall the reduced rate of import duty be lower than the basic rate of ten (10) per cent ad valorem, nor shall the increased rate of import duty be higher than a maximum of one hundred (100) per cent ad valorem; (2) to establish import quota or to ban imports of any commodity, as may be necessary; and (3) to impose an additional duty on all imports not exceeding ten (10) per cent ad valorem whenever necessary: Provided, That upon periodic investigations by the Tariff Commission and recommendation of the NEDA, the President may cause a gradual reduction of protection levels granted in Section One hundred and four of this Code, including those subsequently granted pursuant to this section.

b. Before any recommendation is submitted to the President by the NEDA pursuant to the provisions of this section, except in the imposition of an additional duty not exceeding ten (10) per cent ad valorem, the Commission shall conduct an investigation in the course of which they shall hold public hearings wherein interested parties shall be afforded reasonable opportunity to be present, produce evidence and to be heard. The Commission shall also hear the views and recommendations of any government office, agency or instrumentality concerned. The Commission shall submit their findings and recommendations to the NEDA within thirty (30) days after the termination of the public hearings.

c. The power of the President to increase or decrease rates of import duty within the limits fixed in subsection “a” shall include the authority to modify the form of duty. In modifying the form of duty, the corresponding ad valorem or specific equivalents of the duty with respect to imports from the principal competing foreign country for the most recent representative period shall be used as bases.

d. The Commissioner of Customs shall regularly furnish the Commission a copy of all customs import entries as filed in the Bureau of Customs. The Commission or its duly authorized representatives shall have access to, and the right to copy all liquidated customs import entries and other documents appended thereto as finally filed in the Commission on Audit.

e. The NEDA shall promulgate rules and regulations necessary to carry out the provisions of this section.

f. Any Order issued by the President pursuant to the provisions of this section shall take effect thirty (30) days after promulgation, except in the imposition of additional duty not exceeding ten (10) per cent ad valorem which shall take effect at the discretion of the President.

SECTION 402. Promotion of Foreign Trade. —

a. For the purpose of expanding foreign markets for Philippine products as a means of assistance in the economic development of the country, in overcoming domestic unemployment, in increasing the purchasing power of the Philippine peso, and in establishing and maintaining better relations between the Philippines and other countries, the President, is authorized from time to time:

(1) To enter into trade agreements with foreign governments or instrumentalities thereof; and

(2) To modify import duties (including any necessary change in classification) and other import restrictions, as are required or appropriate to carry out and promote foreign trade with other countries: Provided, however, That in modifying import duties or fixing import quota the requirements prescribed in subsection “a” of Section 401 shall be observed: Provided, further, That any modification of import duties and any fixing of import quotas made pursuant to the agreement on ASEAN Preferential Trading Arrangements ratified on August 1, 1977 shall not be subject to the limitations of the aforesaid subsection “a” of Section 401.

b. The duties and other import restrictions as modified in subsection “a” above, shall apply to articles which are the growth, produce or manufacture of the specific country, whether imported directly or indirectly, with which the Philippines has entered into a trade agreement: Provided, That the President may suspend the application of any concession to articles which are the growth, produce or manufacture of such country because of acts (including the operations of international cartels) or policies which in his opinion tend to defeat the purposes set in this section; and the duties and other import restrictions as negotiated shall be in force and effect from and after such time as specified in the Order.

c. Nothing in this section shall be construed to give any authority to cancel or reduce in any manner any of the indebtedness of any foreign country to the Philippines or any claim of the Philippines against any foreign country.

d. Before any trade agreement is concluded with any foreign government or instrumentality thereof, reasonable public notice of the intention to negotiate an agreement with such government or instrumentality shall be given in order that any interested person may have an opportunity to present his views to the Commission which shall seek information and advice from the Ministry of Agriculture, Ministry of Natural Resources, the Ministry of Trade, Ministry of Tourism, the Central Bank of the Philippines, the Ministry of Foreign Affairs, the Board of Investments and from such other sources as it may deem appropriate.

e. (1) In advising the President, as a result of the trade agreement entered into, the Commission shall determine whether the domestic industry has suffered or is being threatened with injury and whether the wholesale prices at which the domestic products are sold are reasonable, taking into account the cost of raw materials, labor, overhead, a fair return on investment, and the overall efficiency of the industry.

(2) The NEDA shall evaluate the report of the Commission and submit recommendations to the President.

(3) Upon receipt of the report of the findings and recommendations of the NEDA, the President may prescribe such adjustments in the rates of import duties, withdraw, modify or suspend, in whole or in part, any concession under any trade agreement, establish import quota, or institute such other import restrictions as the NEDA recommends to be necessary in order to fully protect domestic industry and the consumers, subject to the condition that the wholesale prices of the domestic products concerned shall be reduced to, or maintained at, the level recommended by the NEDA unless for good cause shown, an increase thereof, as recommended by the NEDA, is authorized by the President. Should increases be made without such authority, the NEDA shall immediately notify the President, who shall allow the importation of competing products in such quantities as to protect the public from the unauthorized increase in wholesale prices.

f. This section shall not prevent the effectivity of any executive agreement or any future preferential trade agreement with any foreign country.

g. The NEDA and the Commission are authorized to promulgate such reasonable procedure, rules and regulations as they may deem necessary to execute their respective functions under this section.

PART 4

Tariff Commission

SECTION 501. Chief Officials of the Tariff Commission. — The Officials of the Tariff Commission shall be the Chairman and two (2) Member Commissioners to be appointed by the President of the Philippines.

SECTION 502. Qualifications. — No person shall be eligible for appointment as Chairman and Tariff Commissioners unless they are natural-born citizens of the Philippines, of good moral character and proven integrity, and who by experience and academic training are possessed of qualifications requisite for developing expert knowledge of tariff problems. They shall not, during their tenure in office, engage in the practice of any profession, or intervene directly or indirectly in the management or control of any private enterprise which may, in any way, be affected by the functions of their office nor shall be, directly or indirectly, financially interested in any contract with Government, or any subdivision or instrumentality thereof.

SECTION 503. Appointment and Compensation of Officials and Employees. — All employees of the Commission shall be appointed by the Chairman in accordance with the Civil Service Law except the Private Secretaries to the Chairman, Commissioners and Executive Director.